If you graduated with your PharmD, you might have anywhere from $50,000 to $350,000 of student debt depending on what kind of institution you went to and how much financial support you had in school from working part-time or from family.

On the lower end of the debt spectrum, refinancing while working for a private employer to pay back pharmacy school loans might make a lot of sense, especially if you want a lower interest rate. But student loan refinance options aren't for everyone. When you owe more than you make, you might want to evaluate the two kinds of pharmacist student loan forgiveness programs.

If you look at the 2022 Graduating Student Survey from the American Association of Colleges of Pharmacy (AACP), the average pharmacy student loan debt is $170,444 for all graduates with loans. Almost 84% of new PharmD degree holders in 2022 graduated with debt. However, I believe this estimate understates the problem for many pharmacists. The average pharmacy school debt we’ve seen with our pharmacist clients has been $234,685. Healthcare professionals tend to have high loan balances.

With daunting debt like that, you want to evaluate all your options, including student loan forgiveness options for pharmacy residents in the not-for-profit and the private sector. You want to make your student loan repayment more manageable and look into any state loan repayment programs that can help.

The Pharmacist salary is under siege

Chains like CVS and Walgreens are making it tough to get full-time hours in parts of the country. Hospitals have figured out they can create residency programs and hire three young pharmacists for the price of one. Clearly, the pharmacist salary has headwinds for above-inflation growth.

In parts of the country, pharmacists will continue to make fantastic incomes and have little problem achieving financial security. Especially in underserved rural areas such as a Health Professional Shortage Area (HPSA), there is a pharmacist shortage and room for negotiation in pay and working conditions and loan repayment assistance options.

I wouldn’t go so far as to say pharmacist salaries are declining overall, but in the toughest parts of the country for pharmacists, they might be. In other areas, pharmacist salary growth has slowed.

The slower growth of pharmacist salaries overall and strong headwinds to future salary growth make pharmacist student loan forgiveness a viable strategy for many recent graduates.

Get Started With Our New IDR Calculator

Getting Public Service Loan Forgiveness as a pharmacist

You could benefit from the Public Service Loan Forgiveness (PSLF) program if you work in a hospital pharmacy or community pharmacy setting. To qualify, you must have federal student loans and be on an income-driven repayment (IDR) plan.

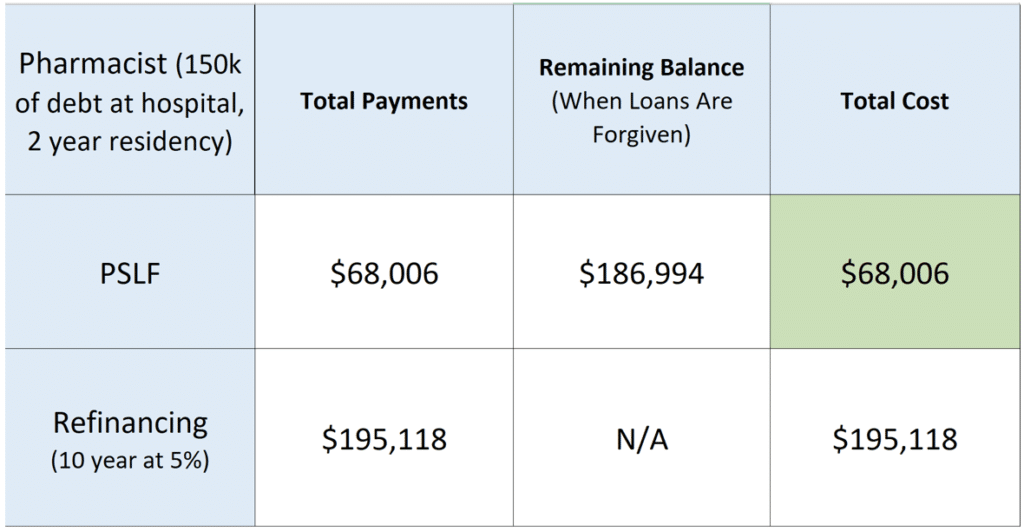

You need to work for ten years at a qualifying nonprofit employer while making payments based on your income. If you had $150,000 of student loan debt all on the Direct Loan Program, you could sign up for the Pay As You Earn (PAYE) plan.

Pretend you do a two-year residency program and earn $110,000 once you’re employed by the hospital. Here’s the cost of PSLF versus refinancing at a 5%, 10-year fixed rate.

This is a compelling benefit worth over $127,000 over ten years of service! Any not-for-profit pharmacist must set their loan balance up to receive PSLF. That said, you should probably not choose a job solely because it qualifies. Make sure to take advantage of the benefit, though, if you want that kind of career.

If you meet eligibility requirements, you can help your personal finance situation and pay less. Borrowers who took out private student loans are sadly not eligible — only federal loans from the U.S. Department of Education are eligible.

Going for pharmacist student loan forgiveness in the private sector

Going for loan forgiveness in the private sector is a little-understood path to pharmacist loan forgiveness. Under this strategy, you need to make 20 to 25 years of payments on an income driven repayment plan like PAYE. You can choose the IBR plan or income-contingent repayment too, but I’ve found these repayment options seldom makes sense to use.

The PAYE plan requires you to pay 10% of your discretionary income as your monthly payments for 20 years. At the end of that period, you must pay taxes on the forgiven balance as if it were income.

If you owe more than 1.5 times your income for most of your career, this strategy could make a lot of sense. Keep in mind you need to include your spouse’s debt and income in this equation if you’re married because the government will include that information.

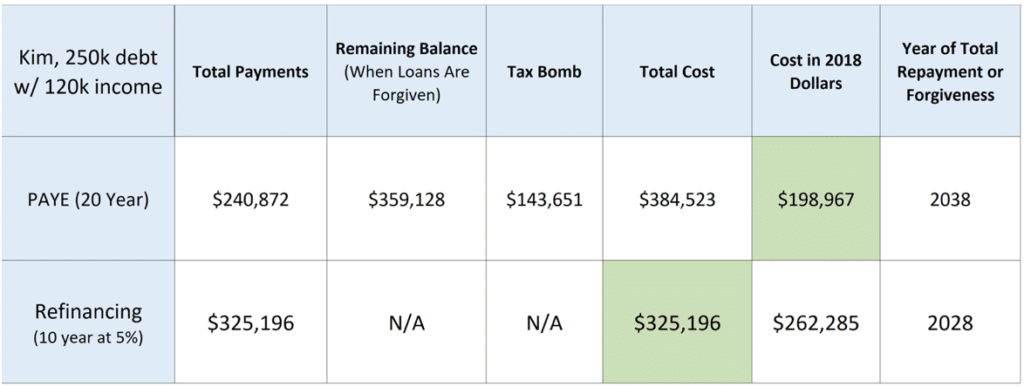

Let's look at an example. Suppose Kim went to Touro College of Pharmacy (one of the most expensive schools in the country) and owes $250,000. She gets a full-time job at CVS, paying $120,000 per year. She could refinance at 5% for 10 years, but she doesn’t like the idea of $2,652 monthly payments for the next 10 years.

On PAYE, she could pay around $900 a month long-term and save about $400 a month in an investment account to cover her tax bomb. The difference could go into her 401k account for retirement.

The PAYE plan, in this case, costs more than refinancing with private lenders in absolute dollars. However, if you use a 5% discount rate, then the cost of PAYE becomes much cheaper in 2018 dollar values.

This is saying that Kim, the Touro PharmD grad, could refinance, or she could have a fully funded retirement account with modest payments. She would also have a six-figure tax bomb account in a taxable brokerage.

One day she may or may not need that money to cover her tax bomb payment to the IRS. If the government passes a law that made student loan forgiveness tax-free, that money would be hers to keep.

The higher the debt-to-income ratio, the better pharmacy student loan forgiveness in the private sector looks. You don’t want to be 40 years old with nothing to show for your years of hard work besides zero debt.

Loophole for part-time pharmacists

Maybe you’ve considered switching to a part-time role for a few years while you raise a family. Maybe you’ve even thought about taking some years away from the labor force. While this should always be your choice, it's one many men and women make so they can have more time with family.

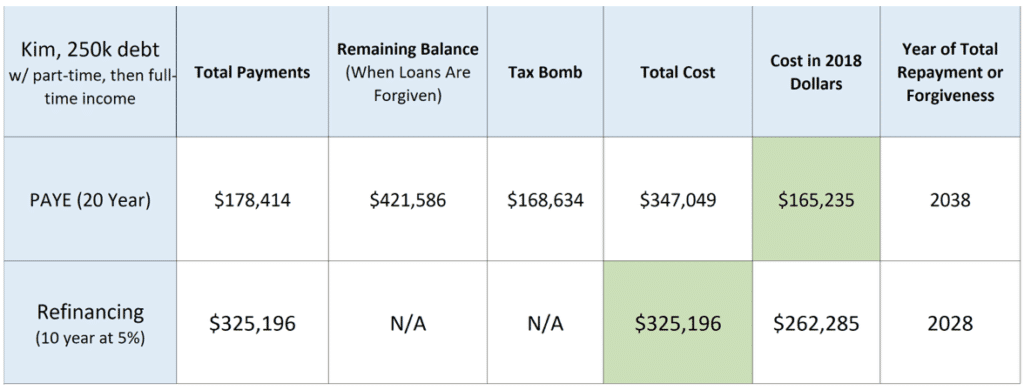

If you make less money, your student loan payments go down, and the value of forgiveness in the private sector goes up. To see how this works, let’s assume Kim, from the earlier example, cuts her hours in half in the first five years of her career for personal reasons.

Look at how the value of federal Public Service Loan Forgiveness increases in today’s dollars.

Even though she only has about five years of lower earnings, Kim would shave off about $33,000 in 2018 dollars off her loan repayment using forgiveness. With private-sector loan forgiveness, your part-time or full-time status does not matter. This is a huge loophole.

It would allow Kim to reduce her payments from $900 a month to about $400 a month while she’s part-time. She would build credit towards the 20 years needed for loan forgiveness, giving her more life flexibility.

Clearly, pharmacist loan forgiveness is about more than just finances. It can also allow you to lead a lifestyle for your family that you dreamed was impossible.

Make a plan for your pharmacy school loans or hire an expert

Review all your options for your pharmacy school loans and make a plan that suits your goals and career. I want to caution that the examples above get more complex if you add spousal debt or income into the picture, which you should do if you’re running a proper analysis.

If you owe a bunch of pharmacy student loans relative to your income, then pharmacy school loan forgiveness through the PSLF program or the taxable 20 to 25-year option could make a lot of sense. Make sure you're making qualifying payments and on the right repayment program. If you need short-term help, evaluate deferment and forbearance options.

Private loan borrowers with good credit scores can research student loan refinancing to obtain a better interest rate. Check out loan terms, repayment terms, and rates. While it's not a pharmacist loan forgiveness program, it can help.

Patients trust you for expert advice and counsel on their medical options. If you’d rather not try to learn this yourself, you can hire us to make a custom plan tailored to your specific situation.

Have experience going for pharmacist student loan forgiveness? Share in the comments!

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.