Imagine that 10 different students graduate with exactly $50,000 in student loans. There’s a strong chance that each of those borrowers would pay a different total amount over the life of their loans. In fact, the total cost could be different by thousands of dollars from one graduate to the other.

What gives? In most cases, these differences will boil down to one key factor — how much student loan interest is paid on the debt. For this reason, minimizing student loan interest is one of the best ways to save on your student loans. This student loan interest calculator will show you how much you could save.

Loan Info

Loan balance Enter your current total student loan balance.

Interest rate (%)

Monthly payment Enter your total monthly payment for all of your student loans combined.

| Interest | Principal | Total | |

|---|---|---|---|

| First Month's PMT | 113 | 245 | 358 |

| Total paid | 16,155 | 35,000 | 51,155 |

How student loan interest works

Student loan interest is calculated by first determining a borrower’s daily interest rate. To find your daily interest rate, divide your annual interest rate by 365. Here’s what that would look like for an interest rate of 6%.

.06 / 365 = .00016

Next, multiply your daily interest by your student loan balance to find your daily interest charge. Here’s how you’d calculate your daily interest charge on a $50,000 loan balance.

$50,000 x .00016 = $8

There you have it. As long as your student loan balance is $50,000, you’ll accrue $8 in interest per day or $240 per month.

When you take out a student loan, the lender calculates how much interest you’ll pay in total over the life of the loan (if paid as agreed). These total interest charges are reflected in your fixed monthly payment.

Like most installment loans that follow an amortization schedule, more of your payment goes toward interest at the beginning. As you pay down your balance, a higher percentage of each payment goes toward the principal.

2 ways to save with the student loan interest calculator

Wondering how you can use the student loan interest calculator to find savings opportunities? Here are two ways that it can help you.

1. Save by making additional payments

One way to save on interest charges is by making extra payments toward the principal. To see how much you could save with this strategy, first use the calculator to determine how much interest you’re paying at your current interest rate.

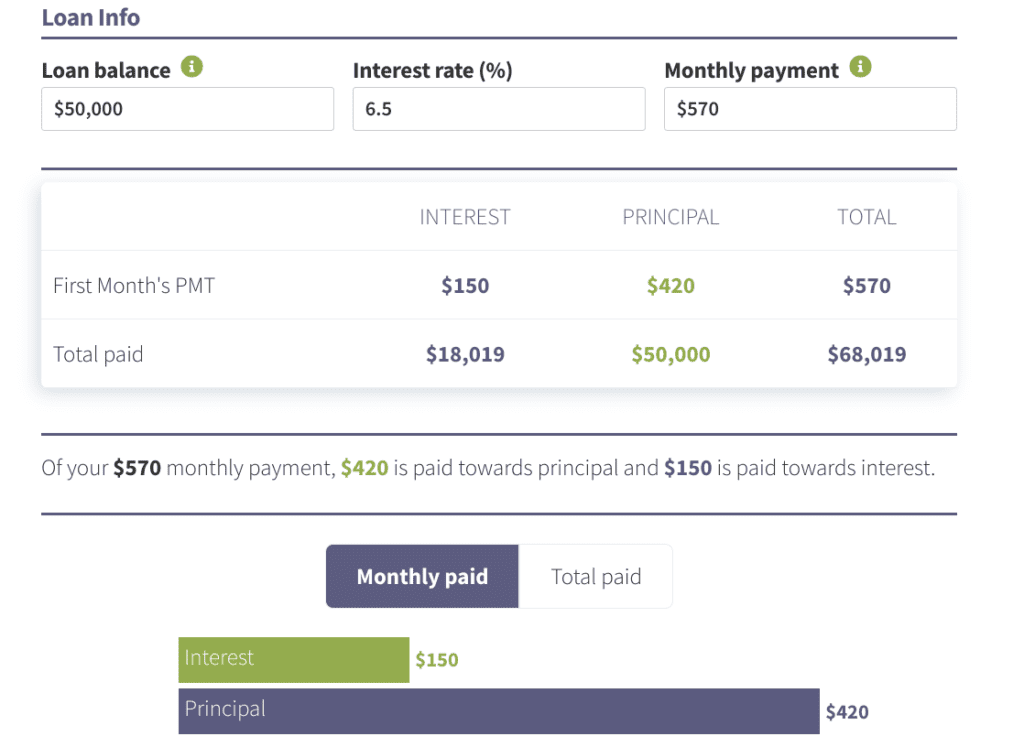

For example, let’s say that you have a $50,000 balance at a 6.5% interest rate and a $570 monthly payment. In that case, you’d begin by paying $150 in interest per month and you’d pay $18,000 in interest overall.

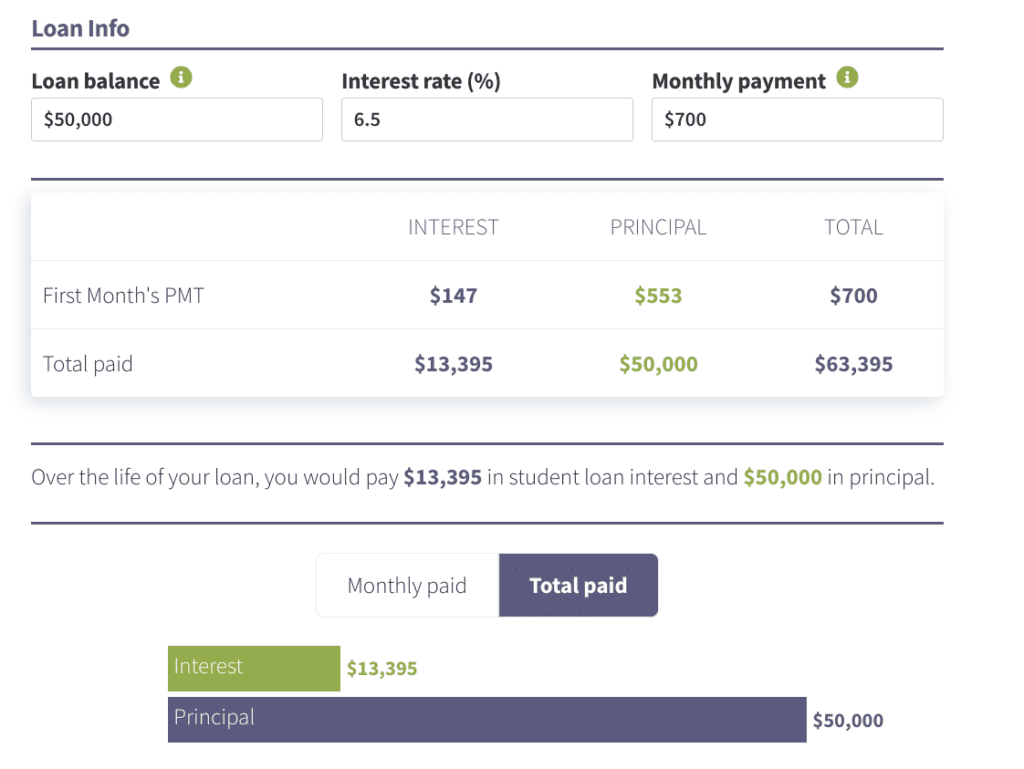

But what if you decided to increase your monthly payment by just $130 to $700 per month? In that case, you’d reduce your overall interest cost to $13,395. That’s a savings of over $4,600.

2. Save by lowering your interest rate

The other main way to save on student loan interest is to reduce your interest rate. There is no way to change the interest rate on federal student loans through the Department of Education. But you may be able to lower your rate by refinancing your federal loans with a private lender.

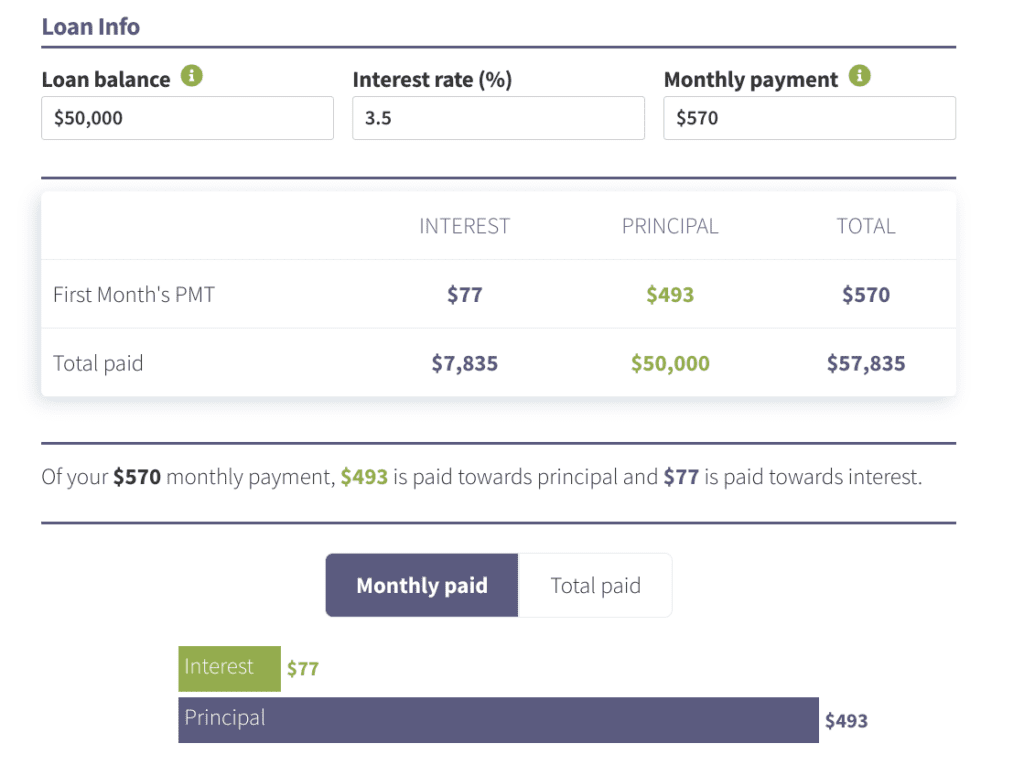

Going back to our sample loan described above, what if you could refinance that 6.5% loan to a 3.5% interest rate. In that case, only $77 of your first payment would be going toward interest. And you’d only pay $7,800 in interest overall — a savings of over $10,000!

And notice that you’d net these savings even while making the exact same monthly payment of $570. So, in this example, you’d actually save more money by refinancing and keeping your payments the same, instead of keeping your interest rate the same and increasing your monthly payment to $700.

Student loan interest FAQs

You probably have a lot of questions about student loan interest. Here are some of the most commonly asked questions:

Do student loans use simple or compound interest?

Compound interest takes place when interest is added to the principal which causes future interest charges to rise. When paid as agreed, student loans do not typically handle interest in this way. However, unpaid interest can be added to the principal (known as capitalization) after a forbearance or deferment period or when a borrower leaves an Income-Driven Repayment (IDR) plan.

Will the government pay my student loan interest for me?

There are certain times that the Department of Education will pay some or all of a borrower’s federal student loan interest on their behalf. First, the government will pay the interest charges on subsidized student loans while the borrower is enrolled at least half-time in school. Second, borrowers may qualify for a subsidy on unpaid interest charges during the first three years of repayment on the IBR and PAYE plans and at all times while on the SAVE plan, formerly called REPAYE.

Can my student loan interest payments reduce my tax bill?

The IRS will allow you to claim a tax deduction for the student loan interest that you pay on your own student loans and your spouse or dependent’s student loans. Currently, the student loan interest tax deduction is capped at $2,500 per year.

Is it possible to lower the interest rate on federal student loans?

Federal student loans come with fixed interest rates. In one sense, that’s a good thing because borrowers can know that their interest rate won’t go up over time. However, there’s also no way to reduce the interest rate on a federal student loan, even if the national average has dropped since you took out your loans. Borrowers can refinance federal student loans with a private lender to secure a lower rate, but the refinanced loans no longer qualify for federal benefits.

Will I pay more student loan interest on an Income-Driven Repayment plan?

In most cases, yes, you’ll pay more student loan interest (and more overall) by joining an IDR plan. The reason for this is that IDR plans extend a borrower’s repayment schedule by 10 or more years compared to the standard repayment plan. More years of repayment also means more years of interest accrual.

One exception to this rule is if the borrower joins the Public Service Loan Forgiveness (PSLF) program and is able to receive forgiveness after 10 years. In this case, both interest and overall cost on an IDR plan would be lower than the borrower would pay on the standard plan.