You might want to minimize your monthly payment (20 year fixed) or minimize your interest (5 year variable), or something in between. See how much money you could save with our student loan refinancing calculator.

Student Loan Refinancing Calculator

Student Loan Balance ($) Enter the total balance of all student loans you wish to refinance.

Current Interest Rate (%) Enter the weighted average interest rate of all of your student loans.

Term Remaining (years) Enter the number of years left until you pay off your current loan(s).

Interest Rate After Refinancing (%) Enter the estimated interest rate of your new (refinanced) student loan.

Term length of new loan (5 years) Enter the term length of your new (refinanced) student loan.

| Monthly Payment | Interest Cost Over the Next 12 Months | Total Interest Paid | |

| Current Loan (10 Year Term at 7%) | |||

| Refinanced Loan (5 Year Term at 5%) |

After Refinancing

| Monthly Payment | Interest Cost Over the Next 12 Months | Total Interest Paid |

Current Loan Amortization Table

Refinanced Loan Amortization Table

Get Started With Our New IDR Calculator

If you need to refinance your student loans, apply at a few of the companies below to see if you can get a lower interest rate (and you could get a huge cash bonus too).

| SoFi | Splash | Earnest | Laurel Road | Education Loan Finance | Credible |

|---|---|---|---|---|---|

|

|

|

|

|

|

|

|

$500

Cashback1

|

$1,000

Cashback2

|

$1,000

Cashback3

|

$1,050

Cashback4

|

$1,275

Cashback5

|

$1,250

Cashback6

|

|

Variable

6.24 – 9.99% APR*1

|

Variable

5.28 – 10.24% APR2

|

Variable

5.89 – 9.74% APR3

|

Variable

5.49 – 9.95% APR4

|

Variable

5.28 – 8.99% APR5

|

Variable

5.28 – 12.43% AR6

|

|

Fixed

5.24 – 9.99% APR*1

|

Fixed

5.19 – 10.24% APPR2

|

Fixed

5.09 – 9.74% APR3

|

Fixed

5.44 – 9.75% APR4

|

Fixed

5.48 – 8.69% APR5

|

Fixed

5.48 – 12.43% APR6

|

|

*Includes optional 0.25% Auto Pay discount. For 100k or more. 1

|

For 100k or more. $300 for 50k to $99,9992

|

For 100k or more. $200 for 50k to $99,9993

|

For 100k+, $300 for 50k to 99k.4

|

For 150k+, $300 to $575 for 50k to 149k.5

|

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k6

|

| Visit Sofi | Visit Splash | Visit Earnest | Visit Laurel Road | Visit ELFI | Visit Credible |

| SoFi |

|---|

|

|

|

$500

Cashback1

|

|

Fixed

5.24 – 9.99% APR*

|

|

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

| Visit Sofi |

| Splash |

|---|

|

|

|

$1,000

Cashback2

|

|

Fixed

5.19 – 10.24% APPR

|

|

For 100k or more. $300 for 50k to $99,999

|

| Visit Splash |

| Earnest |

|---|

|

|

|

$1,000

Cashback3

|

|

Fixed

5.09 – 9.74% APR

|

|

For 100k or more. $200 for 50k to $99,999

|

| Visit Earnest |

| Laurel Road |

|---|

|

|

|

$1,050

Cashback4

|

|

Fixed

5.44 – 9.75% APR

|

|

For 100k+, $300 for 50k to 99k.

|

| Visit Laurel Road |

| Education Loan Finance |

|---|

|

|

|

$1,275

Cashback5

|

|

Fixed

5.48 – 8.69% APR

|

|

For 150k+, $300 to $575 for 50k to 149k.

|

| Visit ELFI |

| Credible |

|---|

|

|

|

$1,250

Cashback6

|

|

Fixed

5.48 – 12.43% APR

|

|

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

| Visit Credible |

Should you refinance?

Student loan refinancing is worth it if you are in a financially stable situation. You should also be willing and able to give up the benefits and protections of federal loans. That is the downside to refinancing.

But in the right situation, it can save you lots of money on your student loan debt repayment.

Typically, finding rates will not impact your credit, but companies will often require a hard credit pull before officially taking on your loan. This will show up on your credit report.

It won’t cost you anything

It does not cost anything to refinance a student loan and it is also not bad to refinance multiple times. In fact, you can use this as a strategy to pay your loans off faster and earn more cash back bonuses.

Read on to find out how your refinancing calculator results measure up in student loan refinancing.

How to know if refinancing your student loan is a good idea

For federal student loans, you should only refinance if the following three points hold true — we call this our refinancing test:

- You have at least three months’ expenses in the bank (emergency fund).

- Your debt-to-income ratio is below 1.5 to 1 (meaning, for example, you make $100,000 but owe less than $150,000 of student debt).

- There’s no chance you could benefit from federal loan programs like the Public Service Loan Forgiveness (PSLF) program.

When you refinance, you lose government protections on your loan debt, such as loan forgiveness and income-based repayment options. If you don’t have an emergency fund and won’t be able to make payments (remember they may be higher), the savings shown in this refinancing calculator could be pointless.

Forgiveness programs are generally a better plan when you owe a lot, relative to your income. Or if you qualify for PSLF. This is the reason for points 2 and 3.

Assuming you passed this refinancing test and know you should refinance, what kind of savings could you expect?

2 ways to save with the student loan refinancing calculator

The first way refinancing your student loan saves you money is by cutting your interest rate.

Lower interest rates

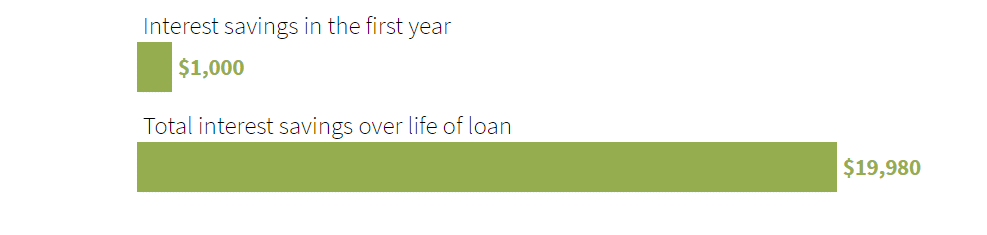

Using the calculator above, you can see if you refinance $100,000 of federal debt at a 6% rate to a 5% rate, for example, you’ll save nearly $1,000 in the first year. If you take 10 years to pay the loan back, you’ll save a total of $19,980 on interest.

Shorter payment terms

The second way to use the student loan refinancing calculator is to see the impact of a shorter payment term. Of course, you can make this higher payment with federal loans, which also carry no prepayment penalties.

The difference is that federal student loan interest rates will never change. In contrast, after refinancing you’ll generally have a lower interest rate and a shorter loan term.

There are many options available. If you could get a 5% rate with a 10-year term, you might get a 4% rate with a 5-year term.

Don’t forget to compare your refinance rates among lenders

When you’re looking at refinancing student loans you need to shop around. Lenders offer different rates, and you’ll want to pick the lowest one. You can start comparing rates by looking at our list of refinancing lenders.

Your credit score isn’t impacted by looking at multiple interest rate offers. That’s because lenders only do a “soft credit pull” when you first get an interest rate quote. Only when you fill out the complete application will it show up on your credit report.

When you get your offers, look at the loan term (length of the loan), interest rates and monthly payment. It’s the right combination of these three things that can lead to savings. You’ll also want to avoid origination fees.

How the refinancing calculator finds you the best deal

Here are some scenarios that explain how much you can save by refinancing.

With a $100,000 loan at a 6%, your standard 10-year payment would be $1,110. If you wished to pay that loan balance off in five years, you’d pay $1,933 a month.

Doing so would save you a collective $17,227 in interest!

Here’s where our calculator can help you find savings:

- A five-year fixed rate of 4% for a $100,000 loan results in a payment of $1,841 instead of $1,933. The total interest savings are $22,725 compared with the 6% 10-year fixed-rate loan. Refinancing, in this case, saves you $5,498 over five years.

- If you stick with a 10-year loan term, you might only get a 5% interest rate. Lenders charge higher rates for longer terms. Your total savings from refinancing are $5,945, as stated earlier. You save slightly more. But those savings are spread out over 10 years. The per-year savings are lower.

So, after refinancing, you could save $1,099 in interest per year with a five-year fixed rate or $594 per year with a 10-year fixed rate. You save more money from refinancing to a shorter term at the cost of a higher monthly payment.

Student loan refinancing FAQs

You probably have a lot of questions about refinancing your student loans. Here are some of the most commonly asked questions:

1. Will you qualify for student loan refinancing?

Every lender has credit and income requirements listed in their eligibility criteria. Typically they also have a minimum for how much you need to refinance.

For example, Earnest requires a minimum of $5000 in student loans, a 680 credit score, loan balances in good standing, and enough savings in the bank to cover at least two months of expenses.

Essentially, the better your credit history and debt-to-income ratio, the better your chances of getting a lower interest rate.

2. When is the best time to refinance your student loans?

For private student loans, you should look into refinancing as soon as you can get a lower interest rate.

If you have federal student loans, reread the first two paragraphs of this article and see if you pass the refinancing test. If you pass, it’s safe to say you should look into refinancing your student loans.

3. Should you choose a fixed interest rate or variable interest rate?

Generally, you should always choose a fixed interest rate. This means your payments will stay the same for the life of the loan. It’s also the basis for the calculator.

Variable rates fluctuate and can end up costing you if you can’t afford to do a very short loan term. For more on comparing these two options check out: How to choose between fixed and variable interest rates.

4. Can you refinance more than once?

Yes, you can refinance more than once. If your credit improves significantly, you can start shopping around again to refinance your student loans. Plug in your numbers to the student loan refinancing calculator above and see how much you could save.

Our last tip: If you refinance to a term longer than 10 years, you save money on a per-year basis. However, you could pay more in total interest just from taking longer to pay off your loan. If you can afford the payments, get the shorter loan term.

5. What is a “weighted average interest rate” and why does the calculator ask for this?

The weighted average interest rate is the average interest rate of your current student loans that also takes into account your balances. Using the weighted average interest rate of your current loans rather than simply a normal average rate yields more accurate results in terms of the savings you'll see from refinancing. You can use a calculator like this one to calculate your weighted average interest rate

Want to learn more about refinancing? Check out our top student loan refinancing lenders here.

If you want a far more powerful copy of the student loan refinancing calculator above, enter your name and email below and we'll send you over a copy you can download and use.