Many physician assistants (PAs) find themselves in loan repayment purgatory which can end up costing them thousands. Most PAs end up here because the combination of making a six-figure salary and owing between $150,000 to $200,000 makes choosing a loan repayment strategy very confusing.

The 10-year Standard Repayment Plan may seem just a touch too high. But while the income-driven repayment plans offer lower monthly payments, they also take longer to pay off and will typically cost more overall.

So some PAs choose the in-between route. Go with an income-driven plan and pay extra toward their loans when they can. On the surface, that sounds like a pretty reasonable plan.

But, actually, this could be the costliest option of all. Why? Because you may end up paying back the full amount before any amount can be forgiven. And that could end up costing you thousands of dollars more in loan repayment. With this in mind, let's look at a few better Physician Assistant loan repayment options.

Get Started With Our New IDR Calculator

Aggressive loan payback vs. maximizing forgiveness

There are typically two paths that make the most financial sense to pay back your physician assistant student loans.

Aggressive repayment

Get the lowest interest rate you can by refinancing and throw all extra money at paying back your loans in 10 years or less. Note that student loan refinancing involves taking out a new private loan which means if you have federal loans, you'll no longer qualify for federal benefits. The private lender will also typically want to see that you have a good credit score and reasonable debt-to-income ratio.

Maximize forgiveness

Sign up for an income-driven repayment (IDR) plan that gives you the lowest payments. Do what you can to lower your AGI and maximize your loan forgiveness.

Note that only Direct Loans are eligible to be paid on IDR plans. However, FFEL Loans and Perking Loans can become eligible if consolidated into a Direct Consolidation Loan. Parent PLUS Loans aren't eligible for any of the income-driven plans either, but can become eligible for the Income-Contingent Repayment (ICR) plan if consolidated.

How to choose

As we've already mentioned, anyone who does the murky middle road ends up paying more out of pocket than they have to. That means more of your hard-earned money goes to the financial institution rather than staying in your wallet. We’re talking tens of thousands of dollars in many cases.

But how does one choose between the aggressive payback or forgiveness maximization approaches? Well, we’ve found that people with a 1.5x ratio of student loans to income might be best to take the aggressive approach. Those with a 2.0x ratio or more might be best suited to take the passive approach.

But here’s the rub for PAs. Many are right smack dab in the middle of that range. And that makes it even more difficult to choose between your physician assistant loan repayment options.

What about Public Service Loan Forgiveness (PSLF)?

Aside from being on the edge of that magic debt-to-income ratio, a physician assistant’s career choice can add another layer of complication. There are a variety of loan forgiveness programs and student loan repayment programs that only certain workers can qualify for.

The Public Service Loan Forgiveness (PSLF) program, which is available to PAs who work for state-run or not-for-profit clinics is probably the most well-known. It offers complete student loan forgiveness of a borrower's remaining balance in as little as 10 years (120 qualifying payments).

But you'll need to consider whether the forgiveness you'd earn would be worth more than the income you might be giving up by forgoing private employment. Later, we'll give more concrete guidelines for how a PA should think through this decision.

Other Physician Assistant loan repayment options

But PSLF isn't the only program designed to help certain PAs repay their student loans. Here are a few more examples:

- National Health Service Corps (NHSC) Loan Repayment Program: Participants can receive up to $50,000 of student loan relief by committing to a two-year service obligation at a qualifying Health Professionals Shortage Area (HPSA). In addition to PAs, qualified medical professionals include primary care MDs, dentists, nurse practitioners, nurse midwives, professional counselors, and more.

- Military Loan Repayment Programs: The College Loan Repayment Program (CLRP) offers up to $65,000 of student loan repayment assistance for Army and Navy recruits (active duty and National Guard). And the Health Professions Loan Repayment Program can offer up to $40,000 of repayment for qualifying Navy and Air Force members.

- Indian Health Service (IHS) Loan Repayment Program: This program can provide up to $40,000 of student loan assistance for qualifying healthcare professionals who promise to serve at least two years in health facilities that serve American Indian or Alaska Native communities. Note that the IHS also offers a scholarship program for students who are still enrolled in their degree programs.

- State Loan Repayment Programs (SLRP): Many states offer loan repayment assistance through their own individual SLRPs. Check out this factsheet from the Health Resources and Services Administration (HRSA) to see what programs may be available in your state.

These are just a few of the many loan repayment program that you may qualify for as a PA. For more information, check out our Complete Guide to Physician Assistant Loan Forgiveness.

PA student loan repayment options = too many

Just to recap, most PAs have to make the choice between the following timeframes:

- Refinancing: 10 years or less

- Signing up for an income-driven repayment plan: 10, 20 or 25 years

- Going for PSLF: 10 years minimum

- Joining an employer-based loan repayment plan in conjunction with any of the three options listed above.

What’s the best way for physician assistants to pay back their student loans?

Kristin is 26 and graduated from PA school a year ago with $170,000 of student loans at 6.5%. Her current salary is $100,000.

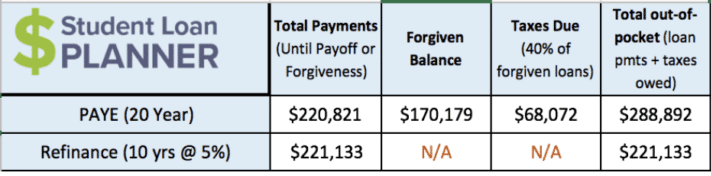

Let’s compare her options between PAYE (the passive approach) vs. refinancing to a lower interest rate (the aggressive approach):

If we’re looking at total loan payments alone, Kristin would spend about the same on PAYE and refinancing. The difference is that with PAYE, that amount is spread out over 20 years vs 10 years.

That means refinancing payments would be much higher than PAYE. Her refinancing payment could be $1,803/month for 10 years vs a starting payment of $685 on PAYE. That’s a $1,200 per month difference.

But wait! PAYE means that the forgiven loan balance of $170,000 is taxed as income, so she would owe about $68,000 in taxes (estimated 40% tax rate) in 20 years. That brings her total out-of-pocket cost for PAYE to $289,000 vs $221,000 on refinancing, a $68,000 higher cost.

So does she go with lower payments and pay back her loans over 20 years? Or does she go for the lower out-of-pocket cost with higher monthly payments and be debt free in half the time?

How can Kristin make the best decision to pay back her loans?

Here are some of the questions that we’d ask Kristin during her consult to help her figure out the best strategy to repay her loans:

“Do you want to still be paying back your student loans into your mid-40s if you would have a lower monthly payment?”

or

“Do you want to be done paying back your student loans as quickly as you can? Yes? Then are you willing to keep your lifestyle the same for a while and throw everything you can at them to be debt-free in less than 10 years?”

This is a personal decision that she might need some professional help figuring out. One of our certified advisors could really help Kristin weigh the advantages and disadvantages of each pathway.

“Is there an opportunity to work for a non-profit hospital? Would a potentially lower salary be worth it?“

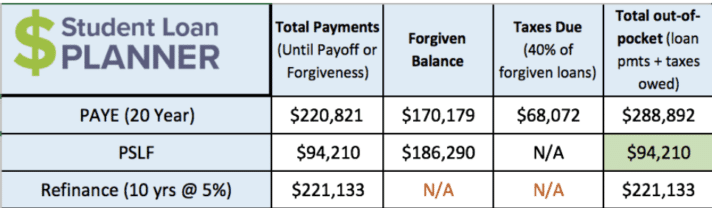

PSLF (Public Service Loan Forgiveness) is an awesome option for physician assistant debt forgiveness if they can work full time for a 501c3 organization (non-profit) or government employer.

How good is it? Pretty darn good.

That’s right, the total cost of her education ends up being 45% cheaper by going with PSLF! There could be a catch though. Maybe the non-profit hospital would pay her less money. So how much more would she have to make in a private job to make it worth it?

Well, she’d be saving close to $130,000 paying back her loans on PSLF vs. refinancing over the same period. That would be a $13,000 after-tax benefit each year. That means Kristin’s pre-tax salary would have to be about $20,000 or so higher working for a private job to give up the PSL benefit.

There is more nuance to it that, which we would dive into on the call, too.

How much more does the purgatory route cost?

What if Kristin thought that $1,800 a month sounded like too much but she could probably afford about $1,400 a month? Let’s assume she can get a 15-year refinancing loan at 5.5%.

In this case, Kristin would end up spending $35,000 more paying back her loan over 15 years vs. 10 years. That’s a rather large number plus it would take her 5 extra years to be debt-free. She’d be better off finding an extra $400 in her monthly budget that she could put towards the loan payment.

If she could only afford $1,200 a month payment, then a 20-year term at 6% would cost her $300,000 in loan payments. That’s about $80,000 more than the 10-year option. It would also be $11,000 more expensive than going for loan forgiveness on PAYE including the estimated tax bomb.

Talking to an expert = clear student loan repayment path + significant savings for PAs

Trying to sort through all the Physician Assistant loan repayment options can be maddening. There are simply so many options available to them. If you’re like the many PAs that we’ve worked with who are struggling to find out the best way to pay back your student loans, we love to help out. Just click the button below to schedule your consultation.

Not sure what to do with your student loans?

Take our 11 question quiz to get a personalized recommendation for 2024 on whether you should pursue PSLF, Biden’s New IDR plan, or refinancing (including the one lender we think could give you the best rate).

Comments are closed.