A 2016 study by the American Psychological Association (APA) found the median anticipated graduate school debt for current students to be $110,000 (excluding undergraduate school debt). The APA study broke things down even further by looking at specific psychology career paths:

- Health service provider fields: $120,000 of anticipated graduate school debt

- Research and other fields: $72,500 of anticipated graduate school debt

- PsyD grads: $160,000 of anticipated graduate school debt

Student Loan Planner® has worked with dozens of psychologists with an average student debt of around $220,000. The truth is that many psychologists are dealing with a huge student debt burden in addition to the emotional burden that comes with the nature of their work.

If you’re a psychologist dealing with a lot of student debt, you may be wondering if refinancing your student loans would be a good choice. Let’s take a look at when student loan refinancing for psychologists would make sense and when it wouldn’t.

Related: Psychologist Salary: A Growing Career with High Student Debt

How student loan refinancing works

The general idea with refinancing is to save money by getting a lower interest rate. As graduates increase their incomes and improve their credit score, they may qualify for lower rates.

But in order to get the best interest rates, you’ll need to have a good debt-to-income (DTI) ratio. In general, you’ll want to owe less than 1.5 times your income.

How much could you save by refinancing? Well, that all depends on how far you can lower your rate.

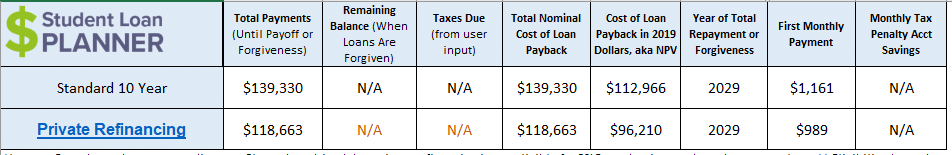

For example, let’s say that you graduate with $100,000 in student debt with an average interest rate of 7%. If you were able to refinance to a private loan with a 3.5% rate, this is how much you could save:

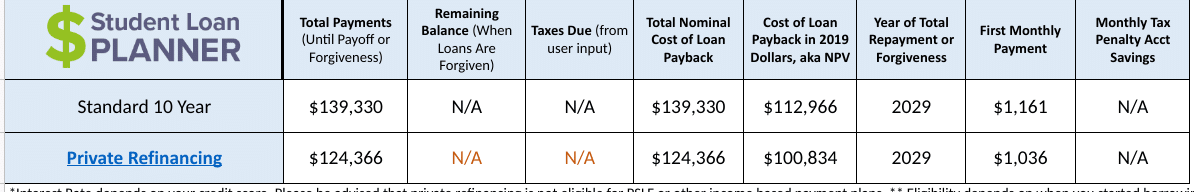

In that case, you’d save over $20,000 in total by refinancing. But let’s say that you’re quoted a 4.5% rate instead. In that case, you’d save nearly $15,000:

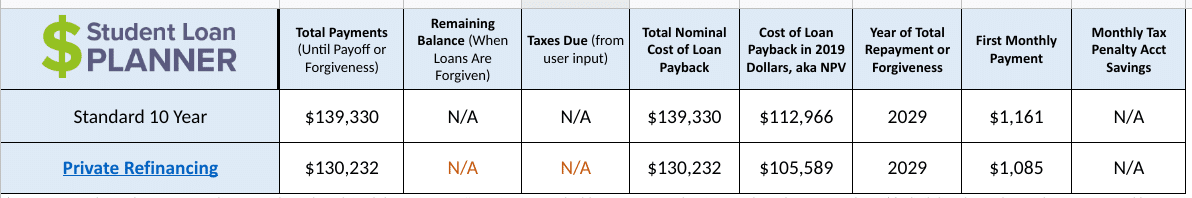

And, finally, if you qualified for a 5.5% interest rate, you’d save a little over $9,000 versus the 10-Year Standard Repayment plan:

Interest rate definitely matters when it comes to deciding if refinancing makes sense. If you’re able to qualify for a great rate, you could save a ton. Otherwise, your savings will be more modest.

Student loan refinancing for psychologists: the problem many psychologists face

The main issue that many psychologists will face is their DTI ratio. According to the Bureau of Labor and Statistics (BLS), the median pay for a psychologist is $79,000.

Remember this is the median pay. Your starting salary could be lower. According to a recent study by the APA, the average full-time salary for recent psychology grads was $55,000 to $65,000.

So let’s say you graduate with $180,000 of student debt and land a job with a starting salary of $60,000. In that case, your debt would be three times your income.

You’ll have a hard time finding any lender who will approve a refinance with that kind of a DTI, especially if you’re hoping to get an attractive rate.

But, as we’ll discuss later, your income could increase significantly after you open your own private practice. At that point, your DTI could improve to the point that refinancing would make more sense.

In the meantime, let’s take a look at other ways to save money on your student loans.

Loan forgiveness for psychologists

Here are a few alternative student loan repayment strategies that psychologists should consider.

Income-Driven Repayment (IDR)

If your student debt total is more than 1.5 times your income, you might want to consider an IDR plan. With IDR, you can make your payments manageable until your income increases.

Using the example from above, let’s say you graduated with $180,000 in student debt and began work with a $60,000 salary. With an IDR plan, your monthly payment would be four to six times smaller than with the Standard 10-Year plan.

If you don’t have Parent PLUS loans, you’ll be choosing from the PAYE, REPAYE, or IBR plans.

With each of these plans, your payment will generally be 10% of your discretionary income. But there are a few differences:

- PAYE:

-

- All loan types are eligible for forgiveness on the remaining balance in 20 years.

- IBR

-

- All loans taken out after July 1, 2014 are eligible for forgiveness after 20 years.

- All loans taken out before July 1, 2014 are eligible for forgiveness after 25 years

- REPAYE:

-

- Undergraduate loans are eligible for forgiveness after 20 years

- Graduate loans are eligible for forgiveness after 25 years.

While the 5 extras of repayment on graduate loans may be a bummer for REPAYE, it’s better than PAYE and IBR when it comes to interest subsidies. Here are the differences.

- PAYE and IBR:

-

- The government will cover the unpaid interest on your subsidized loans only for up to three years.

- After three years, you will be responsible for the remaining interest on your subsidized loans.

- You are responsible for the unpaid interest on unsubsidized loans at all times.

- REPAYE

-

- The government will cover all the unpaid interest on your subsidized loans for up to three years.

- After the first three years, the government will continue to pay half of the remaining interest on your subsidized loans for the remainder of your repayment plan.

- And the government will pay half of the unpaid interest on your unsubsidized loans during all periods.

One more thing about REPAYE. Your unpaid interest will never capitalize unless you leave the plan or fail to certify your income. With PAYE and IBR, unpaid interest will capitalize if you leave the plan or no longer qualify to make payments based on income. For these reasons, REPAYE could be your best choice if you’re worried about unpaid interest (and capitalization) causing your balance to balloon.

Public Service Loan Forgiveness (PSLF)

Do you plan to work in a non-profit clinic or hospital? If so, you should strongly consider joining the PSLF program. When it comes to loan forgiveness for psychologists, it’s hard to beat PSLF. Here are two main benefits that it offers:

- 100% student forgiveness in as little as 10 years (120 qualifying payments)

- No income tax on the forgiven balance

Keep in mind, though, that you may sacrifice salary potential by working at a non-profit agency. In many cases, you may be able to earn significantly more at your own private clinic.

If you’re passionate about public sector work, you might be happy with earning a lower salary. But if your only reason for taking a non-profit job would be to qualify for PSLF, you’ll want to do the math to make sure you’ll truly come out ahead.

NHSC, NIH and employer student loan repayment

In addition to the loan forgiveness for psychologists programs, you might qualify for a loan repayment program.

The NHSC Loan Repayment Program, for example, can provide from $30,000 to $50,000 of student loan repayment assistance for medical professionals in exchange for working at least two years in a Health Professional Shortage Area. Health service psychologists do qualify for the program.

The NIH Loan Repayment Program will repay up to $50,000 of your student debt per year in exchange for you conducting NIH mission-relevant research. And PsyD graduates are eligible to apply for this program. Finally, your employer may offer a student loan repayment program.

If you do receive award money from a student loan repayment program, you’ll want to think through how you use it. For instance, imagine that you receive $50,000 through the NIH program. You’ll need to figure out answers to the following questions:

- Should you immediately apply it to your student loans?

- Or should you use the money to make IDR payments for two years before applying the remaining money toward your principal?

Student Loan Planner®'s guide to student loan forgiveness for psychologists offers instruction for how to think through that.

How should psychologists approach refinancing?

Once psychologists have established their own private practice, that's generally a good time to refinance.

Until then, the debt-to-income ratio for PsyDs can be a problem. Until you start your private practice, you’ll probably want to join an IDR plan like PAYE or REPAYE.

The importance of choosing the right repayment term

When you’re ready to refinance, you’ll need to consider which repayment term would work best.

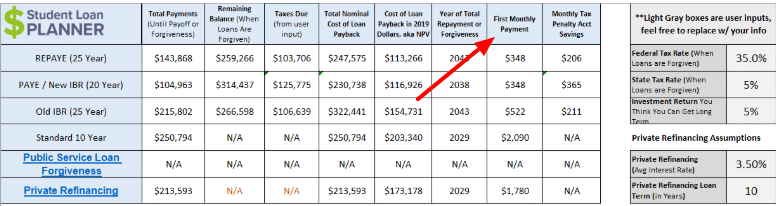

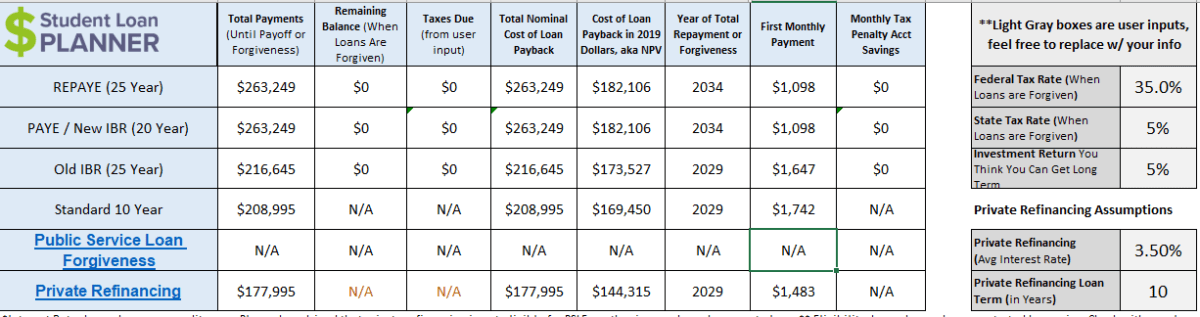

For example, let’s say you have $150,000 in student debt at an average rate of 7% and an annual income of $150,000. By refinancing into a new 10-year loan at 3.5%, your monthly payment would be $1,483. Compare that to the monthly payments associated with other plans in this chart:

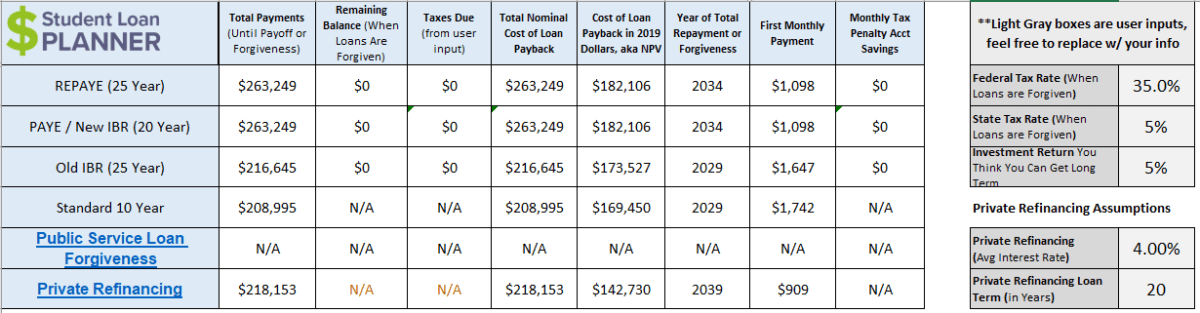

Whether you have a healthy income or not, $1,483 per month is still a significant chunk of change. If you want to get a mortgage or a business loan, you’ll probably want to pick a long repayment term like 20 years.

You won’t qualify for as low of a rate as you might have otherwise, but you’ll have a much better cash-flow situation. And lower monthly debt obligations will help you qualify for a mortgage or other loans.

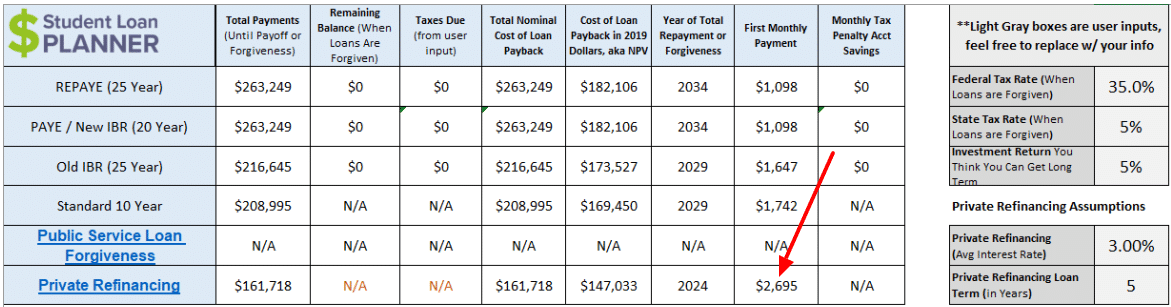

You can qualify for the absolute best rates by choosing a shorter term, like five years. But even so, take a look at that massive monthly payment in this chart:

If you want to go this route, just make sure you have an emergency fund of at least six months' worth of expenses saved up.

Thinking about refinancing? If so, find the best refinancing deals for psychologists.

And make sure to take advantage of the special bonuses that Student Loan Planner® has negotiated for its readers. Student Loan Planner® intentionally earns less than its competitors on referral links so that its readers can keep more money in their own pockets. See if you qualify for a bonus.

Refinance student loans, get a bonus in 2024

| Lender Name | Lender | Offer | Learn more |

|---|---|---|---|

|

$500 Bonus

*Includes optional 0.25% Auto Pay discount. For 100k or more.

|

Fixed 5.24 - 9.99% APR*

Variable 6.24 - 9.99% APR*

|

|

|

$1,000 Bonus

For 100k or more. $300 for 50k to $99,999

|

Fixed 5.19 - 10.24% APPR

Variable 5.28 - 10.24% APR

|

|

|

$1,000 Bonus

For 100k or more. $200 for 50k to $99,999

|

Fixed 5.09 - 9.74% APR

Variable 5.89 - 9.74% APR

|

|

|

$1,050 Bonus

For 100k+, $300 for 50k to 99k.

|

Fixed 5.44 - 9.75% APR

Variable 5.49 - 9.95% APR

|

|

|

$1,275 Bonus

For 150k+, $300 to $575 for 50k to 149k.

|

Fixed 5.48 - 8.69% APR

Variable 5.28 - 8.99% APR

|

|

|

$1,250 Bonus

For 100k+, $350 for 50k to 100k. $100 for 5k to 50k

|

Fixed 5.48 - 12.43% APR

Variable 5.28 - 12.43% AR

|